Stimulating Avenues: EIB Loans and Returns to Public Investment

with Evi Pappa

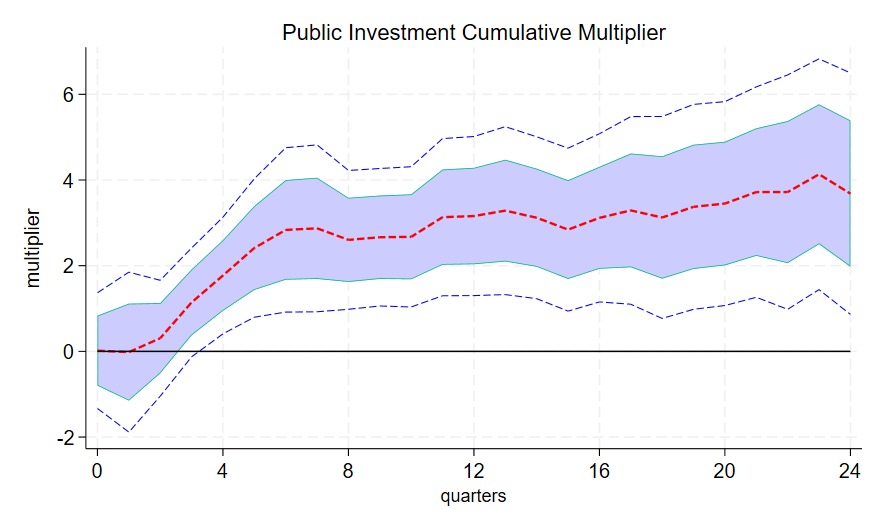

We study the macroeconomic effects of persistent public investment shocks using a local-projection instrumental-variables framework and European data. For identification, we exploit European Investment Bank loans for public infrastructure projects and address potential endogeneity in loan approval with an inverse-probability-weighted regression- adjustment estimator. Public investment shocks raise employment and output in the medium term, without crowding out private investment and consumption, or generating inflation and additional debt burden. The cumulative output multiplier reaches 3.38 after five years and is significant and larger when credit conditions are favorable. We report significant positive spillover effects from spending in public infrastructure in both output and employment.